Stania Suwita Pranoto

Senior Partner

Experience

Stan Pranoto graduated with a Master of Business Administration and Accountancy degree from the University of Tilburg, the Netherlands. He is a certified Tax Attorney and Tax Consultant and has obtained a Brevet C – the highest working license qualification.

Stan was with Arthur Andersen for 19 years and with Ernst & Young for three years, as a Tax and Business Advisory Partner. He was an active member of the International Tax Group with Andersen Worldwide.

He deals with national and multinational clients in various business sectors, such as manufacturing and trading, banking and financial institutions, telecommunications and infrastructure.

Stan advises clients in Tax Planning, Corporate and Financial Restructuring, Merger and Acquisition, Transfer Pricing, and General / Specific Tax Matters.

Professional Summary

• 2006 - Present : Senior Partner SF Consulting

• 2002 - 2006 : Tax Partner, Ernst & Young

• 1983 - 2002 : Tax Partner, Arthur Andersen

• 1982 - 1983 : PT Sungai Budi

• 1980 - 1982 : Auditor, Coopers & Lybrand Netherland

Professional Affiliations

• PT. Sepatu Bata Tbk. - Audit Committee (2017 - now)

• PT. Alam Sutera Tbk. - Audit Commitee (2017 - now)

• PT. Dwi Jaya Tembakau (Subidiary of Burger Holding AG-Swiss) - Commissioner

• Indonesian Tax Consultant Association (IKPI)

• International Fiscal Association (IFA)

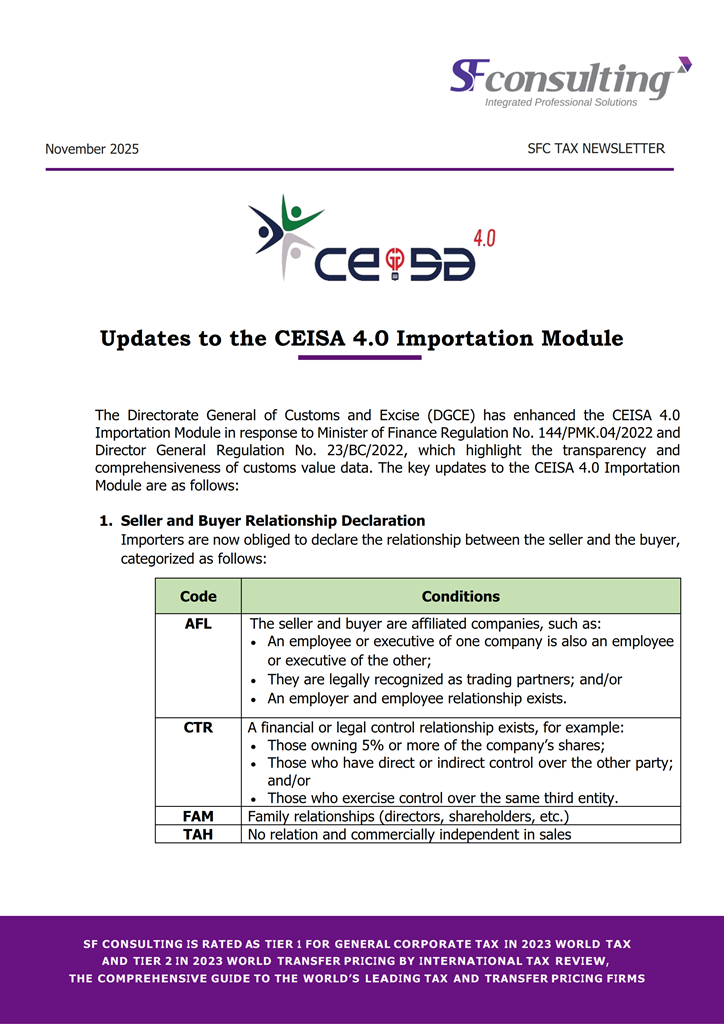

SFc Tax Newsletter November 2025 Follow link below to read more and download the complete article https://tinyurl.com/taxnov2025 Visit our website www.sfconsulting.co.id ...

SFc Customs & Excise Newsletter November 2025 Follow link below to read more and download the complete article https://tinyurl.com/customsnov2025 Visit our website www.sfconsulting.co.id ...

(Washington D.C.) Indonesia dan Amerika Serikat (AS) telah menyepakati substansi utama dalam dokumen perundingan perdagangan resiprokal atau Agreements on ...

(Jakarta) Menteri Keuangan Purbaya Yudhi Sadewa menyiapkan anggaran sebesar Rp 2 triliun untuk mendukung pembiayaan ekspor bagi industri furnitur ...

(Bandung) Memasuki penghujung tahun 2025, kinerja Anggaran Pendapatan dan Belanja Negara (APBN) di wilayah Jawa Barat tercatat tetap solid ...

(Tangerang Selatan) Sebuah perusahaan resmi mengantongi izin fasilitas Pusat Logistik Berikat (PLB) dari Kanwil Bea Cukai Banten. Pemberian fasilitas ...

(St. Petersburg) Menteri Perdagangan RI Budi Santoso menandatangani Persetujuan Perdagangan Bebas Indonesia–Uni Ekonomi Eurasia (Indonesia–EAEU FTA) pada Minggu (21/12) ...

(Jakarta) Direktorat Jenderal Pajak (DJP) memperjelas status perpajakan warga negara Indonesia (WNI) yang tinggal dan bekerja di luar negeri ...

| Mata Uang | Nilai (Rp.) |

|---|---|

| EUR | 17068.99 |

| USD | 15710 |

| GBP | 19949.11 |

| AUD | 10293.61 |

| SGD | 11699.88 |

| * Rupiah | |

Berlaku : 27 Mar 2024 - 2 Apr 2024

NILAI KURS SEBAGAI DASAR PELUNASAN BEA MASUK, PAJAK PERTAMBAHAN NILAI ...

PERUBAHAN ATAS PERATURAN MENTERI KEUANGAN NOMOR 19 TAHUN 2023 TENTANG ...

PETUNJUK TEKNIS PELAKSANAAN PEMBERIAN TUNJANGAN HARI RAYA DAN GAJI KETIGA ...

NILAI KURS SEBAGAI DASAR PELUNASAN BEA MASUK, PAJAK PERTAMBAHAN NILAI ...

JADWAL LAYANAN PAJAK DI LUAR KANTOR (LDK) ATAU POJOK PAJAK ...