Working Partner Tax

Experience

F. X. Sutardjo worked in the Directorate General of Taxation for fifteen years, at the Badora (Foreign Companies and Individuals) Tax Office, PMA (Foreign Investment) Tax Office and as a team member of the IndonesianTax Reform in 1983 and a member of National Taxation instructor team.

He also served for fifteen years with the Directorate General of State Auction under the Ministry of Finance starting 1990. He was a Judge at the Tax Court & Head of Panel of Judges at the Tax Court for five years.

He is currently a lecturer in the Notary Public master’s program at the University of Indonesia. He has also been a lecturer at various universities and National Tax Examination course.

He is a speaker in many workshop and seminar on tax matters, auction and receivership.

Working Partner Customs

Experience

Kusumasto Subagjo worked in the Directorate General of Customs and Exices for more than thirty years. He was Head of Operation Division Directorate Smuggling Eradication, Customs & Excise HQ, Head Intelligence Division, Directorate Smuggling Eradication, Customs & Excise HQ, Head of Customs and Excise Regional Office VI, Directorate General of Customs and Excise Semarang, Head of Other Excise Division, Customs & Excise HQ, Head of Intelligence Civision, Directorate Smuggling Eradication, Customs & Excise HQ.

Kusumasto Subagjo graduated with Bachelor Degree from University of Indonesia majoring Economy and Magister Sains majoring Fiscal Policy and Administration Graduate Program , Political and Social Science of University of Indonesia.

He was a Judge at the Tax Court & Head of Panel of Judges at the Tax Court for nine years.

SFc Tax Newsletter November 2025 Follow link below to read more and download the complete article https://tinyurl.com/taxnov2025 Visit our website www.sfconsulting.co.id ...

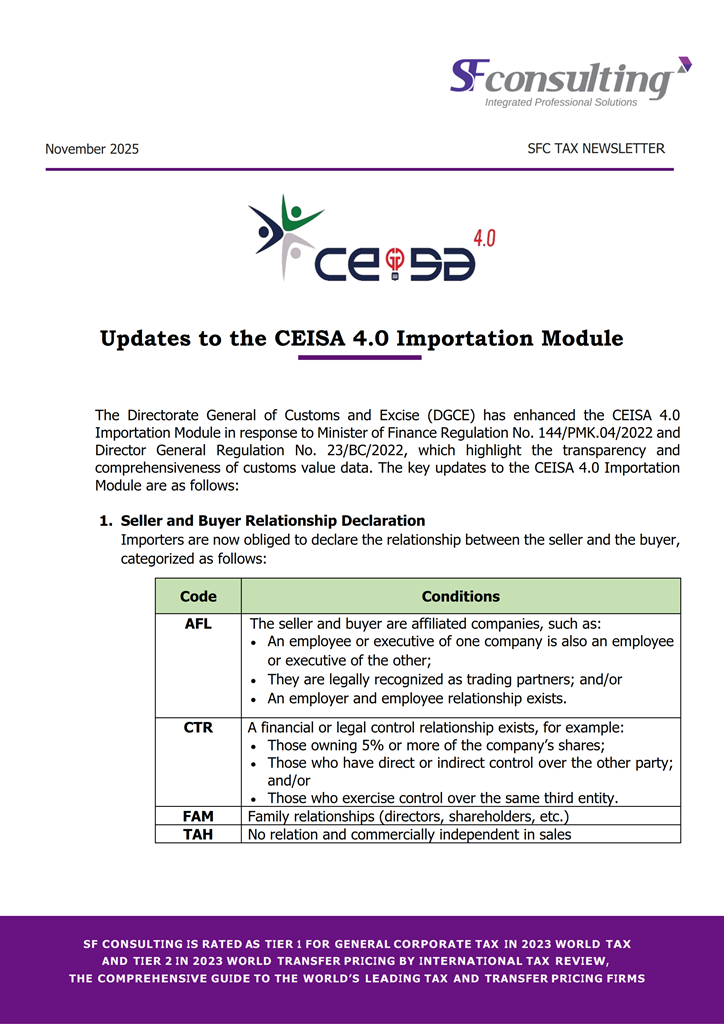

SFc Customs & Excise Newsletter November 2025 Follow link below to read more and download the complete article https://tinyurl.com/customsnov2025 Visit our website www.sfconsulting.co.id ...

(Washington D.C.) Indonesia dan Amerika Serikat (AS) telah menyepakati substansi utama dalam dokumen perundingan perdagangan resiprokal atau Agreements on ...

(Jakarta) Menteri Keuangan Purbaya Yudhi Sadewa menyiapkan anggaran sebesar Rp 2 triliun untuk mendukung pembiayaan ekspor bagi industri furnitur ...

(Bandung) Memasuki penghujung tahun 2025, kinerja Anggaran Pendapatan dan Belanja Negara (APBN) di wilayah Jawa Barat tercatat tetap solid ...

(Tangerang Selatan) Sebuah perusahaan resmi mengantongi izin fasilitas Pusat Logistik Berikat (PLB) dari Kanwil Bea Cukai Banten. Pemberian fasilitas ...

(St. Petersburg) Menteri Perdagangan RI Budi Santoso menandatangani Persetujuan Perdagangan Bebas Indonesia–Uni Ekonomi Eurasia (Indonesia–EAEU FTA) pada Minggu (21/12) ...

(Jakarta) Direktorat Jenderal Pajak (DJP) memperjelas status perpajakan warga negara Indonesia (WNI) yang tinggal dan bekerja di luar negeri ...

| Mata Uang | Nilai (Rp.) |

|---|---|

| EUR | 17068.99 |

| USD | 15710 |

| GBP | 19949.11 |

| AUD | 10293.61 |

| SGD | 11699.88 |

| * Rupiah | |

Berlaku : 27 Mar 2024 - 2 Apr 2024

NILAI KURS SEBAGAI DASAR PELUNASAN BEA MASUK, PAJAK PERTAMBAHAN NILAI ...

PERUBAHAN ATAS PERATURAN MENTERI KEUANGAN NOMOR 19 TAHUN 2023 TENTANG ...

PETUNJUK TEKNIS PELAKSANAAN PEMBERIAN TUNJANGAN HARI RAYA DAN GAJI KETIGA ...

NILAI KURS SEBAGAI DASAR PELUNASAN BEA MASUK, PAJAK PERTAMBAHAN NILAI ...

JADWAL LAYANAN PAJAK DI LUAR KANTOR (LDK) ATAU POJOK PAJAK ...